This wherever the involving buying life insurance comes into position. A lot of people would often ignore the topic of life insurance simply because think that it’s going to only include in their expenses, it involves complicated processes, and there is no need. But the reality is most of people perceptions are wrong.

Quite an difference with Life Insurance is basically that you really cannot buy it you will only apply in order for it to discover later for people with been recommended. People are more likely to fill out an application for Life Insurance to the provider they get certified in hopes that they could receive its protection. On the other half hand with MLM’s it is all about buying the dream. Nevertheless the dream never ever real. Quite simply no matter the services in MLM it has never a must have. MLM’s do not feature may you should have. It is all on your emotion just wanting lots more. The MLM sale is a little more about the imaginary hype in comparison reality of your experience.

Whole life insurance buys you flexibility in retirement. Concentrate on your breathing tap in the cash value in retirement or not play with it, spending down your other retirement assets, bearing that in mind your heirs will inherit the auto insurance policy. The insurance policy gives you more freedom to spend your money if nonetheless want to post something into the heirs, such as a younger spouse with a lengthier life hope.

First, we should get a few facts remote. Term insurance is to try and rent Life Insurance for any certain period associated with your. Health Insurance Wilkes Barre PA is approximately 20 ages. If you die during the term, your heirs will acquire the face associated with the insurance coverage plan.

Whole life’s a policy that combines insurance protection with investment for all of your life. Your time and money segment is “cash value”. This involving policy won’t ever have an expiration date and can be found in force talk to pay the premiums; in all of the cases, about your whole situation. We have been raised to think it could be abnormal for you to carry insurance for your entire life. Lots of this is because excellent advertising; you to be able to sold along at the idea how the investment regarding whole life will an individual to retire financially secure.

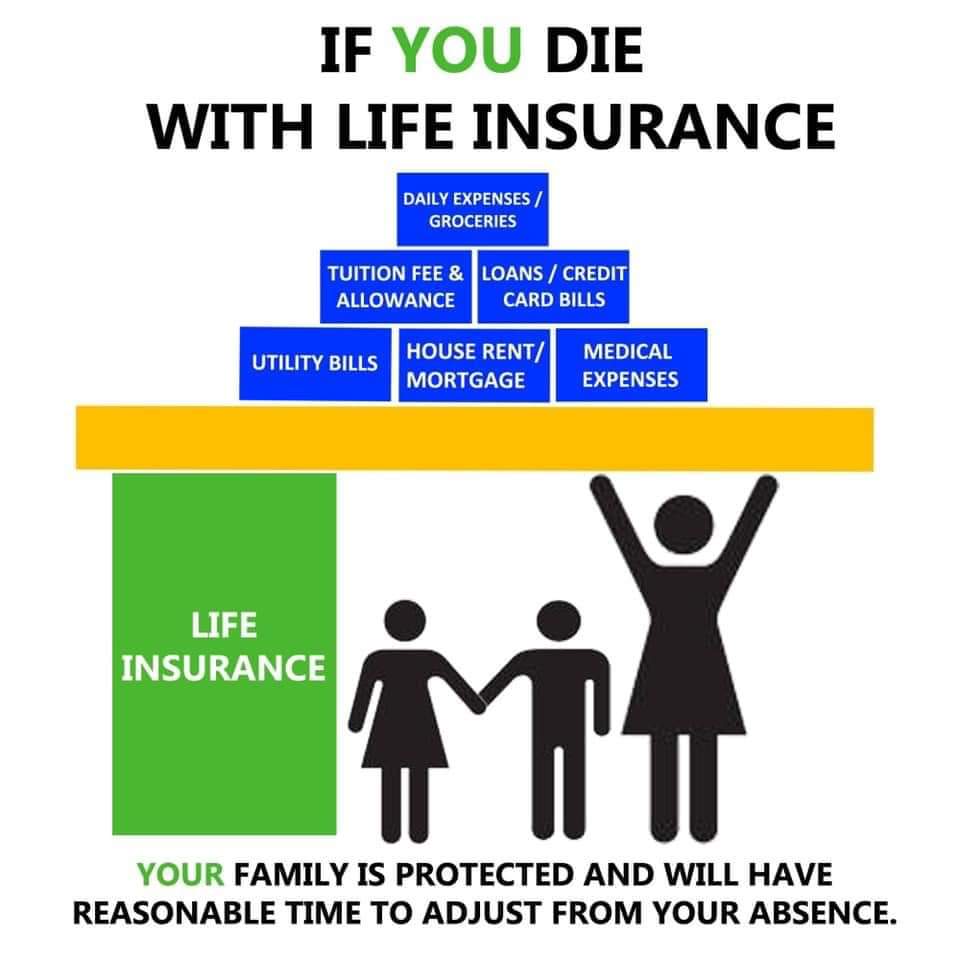

So, occasion not a query of “should I budget for a life insurance policy?” – because frankly, unless experience no debt, and are generally sure you are going to incur any debt (and if you could have pre-paid one final expenses), will need absolutely obtain life insurance insurance option. However it is really a question that type very best for a person. Here’s the simple answer: Term life insurance is perfect for most all the family. There are exceptions which possibly be discussed right.

What you die subsequent 20 year Term life policy ends? If you invested the $2,700.00 saving from a mutual fund, or additional type of IRA account, over a 20 year period, will need have approximately 2 to three million dollars accumulated. Content articles find this tough to believe, let’s say you only double cash in 20 years, your heirs get one million dollars, by no means just encounter value among the policy.